Credit and the Student Budget

Photo by The New York Public Library on Unsplash

As a mature student I consider myself fortunate to have lived in the real world, managing household expenses, savings, and living within my means. Gratefully I plan to leave University without much debt.

I think for most students the reality is quite different. Most students expect to come out of University with student debt, credit card debt, or loans/line of credits that are put off until it is possible to find full-time work – hopefully in a skilled arena that pays enough to consider the risk worthwhile.

Good Debt vs Bad Debt

Accumulating student debt is considered worthwhile because it is in the category of “good debt”. Bad debt is considered to be harmful because there is no return on the investment. Whereas a house can be lived in, or a car used for the commute, racking up debt to fund an eating out habit or lavish lifestyle is considered a bad choice when the income is not there to justify the extra expense.

The so-called good debt of student loans can be viewed as an investment in a potential future career, assuming that school leads to career, which I know I am counting on! That being said, I know of few students that can survive on what they get from student loans, and the rest needs to be made up somehow.

Source: Photo by rupixen.com on Unsplash

Use Cash Instead of Plastic

I recently read two books that have changed my perspective on credit and debt. The first, called “The Wealthy Barber Returns” by David Chilton, describes how debit and credit cards have made spending money so much easier.

Once we get into the mindset that we can “charge it”, we unconsciously bypass any accountability – that is until we get our monthly statement. He advocates for people to get physical cash from their account and limit spending based on a predetermined amount – what we have in our wallet. Admittedly, this won’t work if credit cards are the preferred payment, because the company will charge interests from the moment cash is withdrawn, instead of the next posting date on your account.

Source: Photo by Blake Wisz on Unsplash

The other book is called “Crushing Debt: Why Canadians should drop everything and pay off debt” by David Trahair. He looks at our tendency as Canadians to spend on average 148% of our income, and that in general we have lost our discipline to spend within our means.

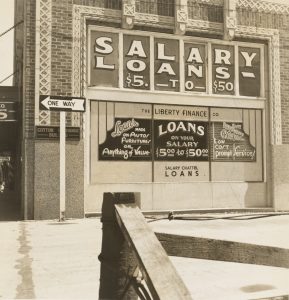

Chalk that to aggressive credit card loans given to young adults, especially students, before having any real understanding of the way credit cards work. Putting off paying for an item makes sense when there is income to justify it, but in many cases the purchases are unnecessary.

So, with the inevitable student debt looming, payable beginning graduation, it makes sense to keep credit card debt to a minimum and avoid the obscenely high interest rates owed on any outstanding balance. Taking a gamble that student debt will be easy to pay off with a decent job at graduation makes sense, though there is no guarantee what the job market will present at that time.

At several times during my academic career, I have slowed my pace of study so that I could work more. Still, there is value to getting through the program as fast as possible because that means entering the work force sooner. It’s a balance, especially as a mature student wanting to complete school soon, and get on with that career that will justify all this hard work now.

Be Disciplined and Set Limits

Bottom line – there is considerable advantage to spending within your means. I had to learn this lesson the hard way. At age 18 I was offered a credit card beginning with $1200. At that time, the rules were more relaxed, and without my permission the company raised my limit to $2400. After a couple years it was at $4800, and finally $9600.

That’s right, the credit card company kept doubling my credit limit without asking me! Bear in mind that I had no income because I was a student at that time, and the little money I was making did not justify a loan of that size. Now the regulations prevent companies from that sort of predatory lending, but so long as your credit scores are good, you can have no income and still rack up a sizeable bill.

Photo by Georgia Vagim on Unsplash

My project this season is to learn how to spend within my means, how to save money, and pay down the small amount of debt I have accumulated. It’s tough, especially as a student, when many of my friends are out having a good time, and I’m stuck at home watching Netflix, eating homemade popcorn.

I tell myself that school is to build my future, so I am working to make sure that I come out of it in the best financial position possible, by not creating a debt load beyond what is necessary. In my next blog I will explore how being frugal as a student can mean saving money and still having a great time.

As a senior leader with a local credit union, Aaron I admire your commitment to help others understand debt. All financial institutions see people every day who ‘slid down the debt slope’ and find themselves in a really challenging spot that takes over their lives in terrible ways.

Two other tips: stay away from e-commerce. Surfing Amazon or eBay can be addictive, and way too easy to part with your money. Just the action of having to physically go to a store can help separate the needs from the wants. And if carrying around a lot of cash doesn’t work for you, a responsible option is to go to your financial institution and set up your ATM/Member/Debit card to only be able to access a daily spending account. Monthly or every two weeks go to your branch, and transfer your spending budget from a savings account into that card-accessible account. Now for that period you can still pay for things with the convenience of plastic, but you’ve put a control on how much is available (and none of it’s debt.)

Looking forward to your next post.

Thank you Brian for your thoughtful comment, and I’m glad you enjoyed the article.

Yes I can appreciate the necessity for debit cards in our society, especially for larger purchases that would make carrying cash onerous. One thing I do is keep a separate account for payments that are auto-debited, so I know that my basics will be covered.

It’s true that online shopping has become extremely easy – any hour of the day or night. For those who are disciplined enough, online shopping is a great way to compare prices in various stores and online platforms. This is only helpful if the purchase is well thought through or planned. I think that impulse buying is part of why so many people abuse credit.