By Krista Boehnert. Originally published in the summer 2020 issue of Business Class magazine.

2020 marks the sixth year of the Gustavson Brand Trust Index, a study which tracks Canadians’ trust in consumer brands. Like most things in 2020, the research team was thrown a curve ball in March when the impact of COVID-19 fully hit Canada. Initially, the team had gathered data from consumers during the weeks of January and February, tracking the trust in brands across a variety of dimensions, including functional trust (how well the brand performs its task or service), relationship trust (how well the brand handles consumer interactions) and values-based trust (how well the brand embraces sustainable and socially responsible practices).

Just as the team began to analyze the data in early March, the country’s economy was put on pause and Canadians’ daily lives changed drastically in the wake of the pandemic. In response, the brand trust research team quickly mobilized a follow-up study to gauge any changes in consumer trust of brands that found themselves in the crosshairs of the pandemic, such as delivery services and hotels.

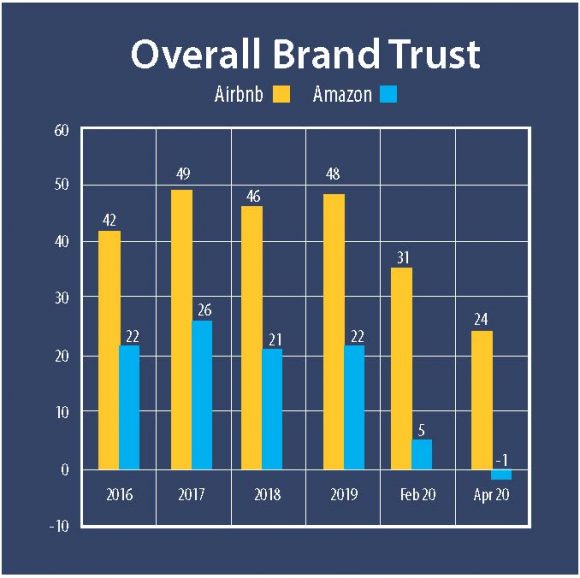

In both surveys, Canadian trust in consumer brands is on the decline. For some brands, such as Amazon, the drop in trust is starker, even as we find ourselves more reliant on its services during the pandemic. In 2019, Amazon dominated our specialty retailers category, scoring third among brands for delivering on their promises and fourth on customer concerns; but 2020 results have shown a sharp decrease in brand trust among consumers. In recent months, the company has faced its share of controversies, from questionable business practices to poor employee treatment and working conditions to concerns around privacy issues. And although consumers are placing orders for items in increased numbers since stay-at-home orders have left people with fewer options to acquire goods, Amazon’s trust score did not experience a resurgence in the second survey results. The research team will continue to monitor trust levels and is eager to see if the 2021 survey shows some trust recovery for Amazon in the future.

In both surveys, Canadian trust in consumer brands is on the decline. For some brands, such as Amazon, the drop in trust is starker, even as we find ourselves more reliant on its services during the pandemic. In 2019, Amazon dominated our specialty retailers category, scoring third among brands for delivering on their promises and fourth on customer concerns; but 2020 results have shown a sharp decrease in brand trust among consumers. In recent months, the company has faced its share of controversies, from questionable business practices to poor employee treatment and working conditions to concerns around privacy issues. And although consumers are placing orders for items in increased numbers since stay-at-home orders have left people with fewer options to acquire goods, Amazon’s trust score did not experience a resurgence in the second survey results. The research team will continue to monitor trust levels and is eager to see if the 2021 survey shows some trust recovery for Amazon in the future.

In some cases, entire sectors are facing distrust from Canadian consumers. From 2016-2018, the hotels category was the highest-ranked category in our study, but in the past two years we’ve seen a decline in trust in the industry. But don’t think it’s because consumers have transferred their love to the sharing economy: Airbnb reached a new low in consumer trust, ranking in our 2020 results with a whopping 17-point drop in its overall trust score and a negative values-based trust score. The hotel sector is one area that has unquestionably been hit hard by COVID-19, and, facing distrust from consumers prior to the pandemic, it is certainly an industry to watch, especially given customers’ new expectations and anxieties around cleaning and disinfecting shared spaces.

In an ever-changing environment, one thing is certain: consumer skepticism is on the rise. Companies which are able to gain and retain consumer trust will thrive, while those unable to overcome this hurdle will face steep challenges ahead.

The full results and data analysis of this year’s surveys are now live at uvic.ca/gustavson/brandtrust.

Photo: Dan Dennis on Unsplash.