by John Holmes (this article originally appeared on John Holmes’ blog, APE: Alcohol Policy and Epidemiology)

Last Friday, the Scottish Government and public health campaigners celebrated the news that minimum unit pricing (MUP) was, once again, legal. Scotland’s highest court had ruled that the Scotch Whisky Association’s (SWA) appeal against an earlier judgement was not well-founded and that the policy was compliant with European law. See here for the BBC’s report and here for the full judgement.

The decision surprised many as just 10 months ago the Guardian and many others had announced “Minimum alcohol price in Scotland breaches EU law” after the European Court of Justice set out legal hurdles which, seemingly, the policy could not clear. A story may be written about how journalists reached such definitive and wrong conclusions within minutes of receiving a judgement which actually said something quite different. However, that is for another day. For now, I will try to explain why the legal hurdles were more surmountable than the headlines suggested and why Friday’s decision turned out the way it did.

First, we need to understand the role of each court in this process. In 2014, the Outer House of the Court of Session ruled that MUP was legal and rejected each of the SWA’s grounds for requesting a judicial review of the Scottish Government’s legislation. The Outer House also refused to refer the case to the European Court of Justice (ECJ). The SWA appealed and the Court of Session’s Inner House, the highest court in Scotland, agreed that a ruling was required by the ECJ to clarify several points of European law. The ECJ interpreted these points of law and the case returned to the Inner House. However, there are two crucial points in what happened next:

- First, the Inner House did not undertake a full reassessment of the evidence in light of the ECJ’s ruling. Instead, it considered whether the Outer House had erred in its judgement and whether new evidence pertaining specifically to the ECJ’s ruling should change that judgement.

- Second, as instructed by the ECJ, the Inner House did not seek to substitute its own assessment of the evidence on MUP for that of the Scottish Government. Instead it more simply assessed whether the Government had behaved reasonably and had used appropriate evidence to assess whether the policy met any legal requirements.

These two points are important as, in different ways, they narrowed the scope of the case to focus only on whether the Outer House and the Scottish Government had made reasonable decisions rather than going back to square one and looking at the evidence afresh.

With that in mind, we can begin to understand why the Inner House swept away much of the SWA’s case in short order (obviously, in legal terms, short order includes 40 pages of preamble). Yes, the previous judge had identified the correct legal test to apply. Yes he had correctly identified the aim of the Government’s legislation. Yes the Scottish Government were also justified in believing the policy to be effective given the evidence before them. No, the SWA’s slapdash hired gun hatchet jobs on that evidence do not count for much here.

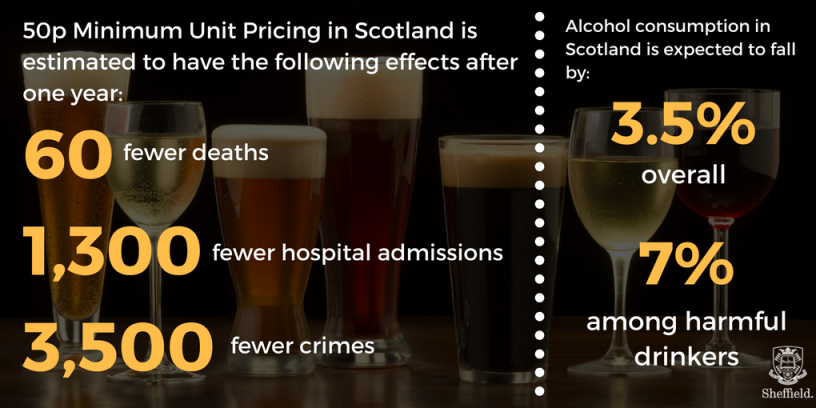

So the case came down, as was always likely, to whether MUP was a proportionate policy under EU law. In other words, does MUP either achieve greater benefits for public health or impose fewer restrictions on the free movement of goods than other existing policy options (for which read: alcohol taxation). This was the hurdle that the ECJ asked the policy to clear and on which new evidence had been submitted, including two studies by our team at Sheffield comparing the effects of taxation and MUP. This was also the hurdle which left people who read both the ECJ’s judgement and the subsequent news reports slightly puzzled. Given public health researchers had long-argued (and in some cases evidenced) that MUP reached the places that alcohol taxation could not, why would the Scottish courts not find that the hurdle had been cleared? With hindsight, it seems hard to believe the case could have gone any other way; although perhaps the seeming conclusiveness of the court’s ruling is colouring my view.

Returning to Friday’s ruling, the opening sentence of paragraph 196 is, for the lay reader, the only one that really matters. It says: “the fundamental problem with an increase in tax is simply that it does not produce a minimum price”. At that point, the die is cast. In some places, the tone of the ruling on this point seems almost to suggest the court is surprised that it has been asked to adjudicate on something so self-evident. It goes on to discuss the advantages of a minimum price including that supermarkets may not pass alcohol taxes onto alcohol prices (we’ve looked at that too), the scale of tax increases needed to achieve the same effect as an MUP (and that), the direct linkage of the minimum price to alcoholic strength, the impossibility of trading down to cheaper products and so on. But, ultimately, the court argues: “It is reasonable to conclude that alternative measures, including increases in taxation are not capable of protecting life and health as effectively as minimum pricing”. Then, with one last swipe at those unwilling to accept anything but an all-encompassing and incontrovertible evidence base (and some stuff about agricultural regulations) the SWA’s appeal was rejected.

Until it appeals to the UK Supreme Court. If it does, because it might not. But it probably will.

Want to read more about MUP and alcohol pricing?

You can find all of our research on alcohol pricing policies on a dedicated page on the Sheffield Alcohol Research Group’s website. This includes both methods and policy analysis articles. It also includes reports on the estimated effects of alcohol pricing policies in England, Scotland, Wales, Northern Ireland, the Republic of Ireland and Canada. There’s also research there on Screening and Brief Interventions (SBI or IBA) and our work underpinning the new UK lower risk drinking guidelines.

John Holmes is a Public health researcher in the Sheffield Alcohol Research Group, ScHARR, University of Sheffield