Electricity generation in Ontario has become a contentious issue as prices have nearly doubled since 2006. The bulk of the cost increase is attributed to the Global Adjustment, which is a fee added to consumers’ bills to cover the difference between the cost paid to generate electricity and the revenue received in the electricity market. According to the Auditor General of Ontario, the Global Adjustment has cost $37 billion since its inception in 2006 [1]. This article explains the components of the Global Adjustment.

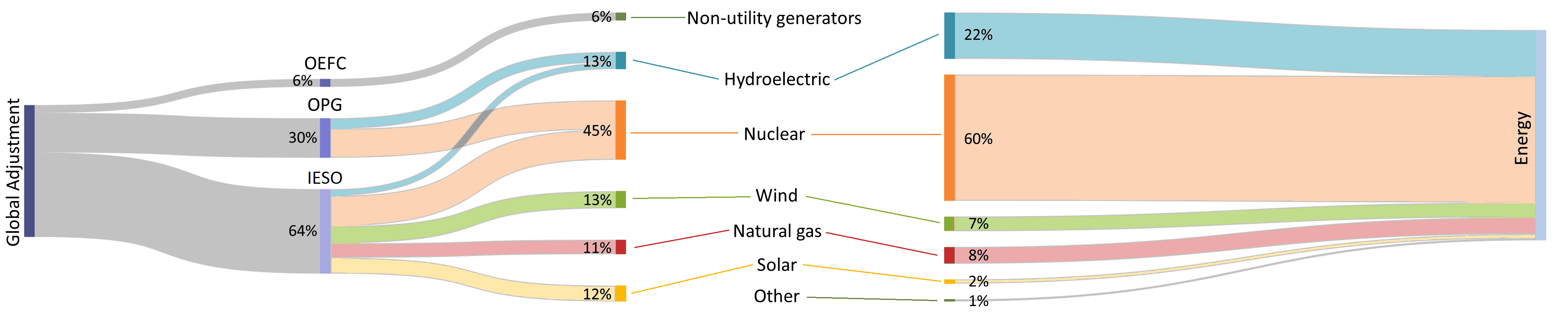

The Global Adjustment is divided into three portions corresponding to three groups of contracted generation. These correspond to entities created from the division of Ontario Hydro in 1999. These organizations, their generation types, and the portion of the Global Adjustment they are forecast to receive in 2016 are shown in Figure 1 [2].

Figure 1: Breakdown of the portion of the Global Adjustment (left) and electricity generation (right) by generation type. Values are from the Ontario Energy Board’s November 2015 rate plan. Global adjustment costs for non-utility generators by fuel type is not available.

The first, the Ontario Electricity Financial Corporation (OEFC), handles the debt from the former Ontario Hydro and existing contracts with non-utility generators. Non-utility generators are electricity generators that are operated by private entities. These generators are primarily small units providing electricity to the grid in addition to services to the local community such as steam heating. There are currently 35 such generators with contracts with the OEFC, the majority of which are fueled by natural gas. As these contracts expire the generators can enter in to new contracts with the Ontario Power Authority. In 2016 payments to non-utility generators are expected to account for $0.7 billion (6%) of the Global Adjustment.

The second portion is payments to Ontario Power Generation (OPG) to cover the difference between the regulated rates that OPG receives and the market cost of the power. OPG inherited the generating assets of Ontario Hydro. Since its inception, OPG has closed or converted all its coal-fired generators and expanded its hydroelectric capacity. The majority of OPG’s generation (approx. 13,000 MW) is produced by generators that receive fixed prices for their energy at a rate set by the Ontario Energy Board (OEB). These facilities receive rates from $42.75/MWh for some hydroelectric facilities to $67.60/MWh for nuclear generation. In 2014 these facilities accounted for 57% of all electrical energy production in Ontario. For 2016, OPG is projected to receive $3.4 billion (30%) in Global Adjustment payments.

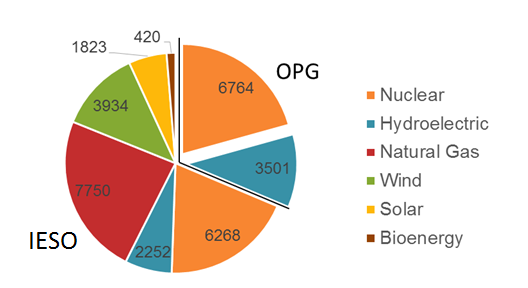

The final portion of the global adjustment is the most complicated and covers payments from the Independent Electricity System Operator1. These payments include contracts with gas-fired facilities, renewable generators, and the Bruce Nuclear Generating Station as well as the cost of conservation and demand response programs. The contracted capacity by type for both the IESO and OPG is given in Figure 2 [3], [4].

Figure 2: Breakdown of contracted capacity by organization and type in megawatts. The OEFC does not publish updates of currently contracted non-utility generators; these facilities are not included in this figure. Contracted capacity is 32,712 MW out of 37,314 MW total capacity.

Figure 2: Breakdown of contracted capacity by organization and type in megawatts. The OEFC does not publish updates of currently contracted non-utility generators; these facilities are not included in this figure. Contracted capacity is 32,712 MW out of 37,314 MW total capacity.

The largest fraction of the energy paid for under the IESO portion of the Global Adjustment is from the Bruce Nuclear Generating Station. This station consists of eight units divided into two portions, Bruce A and Bruce B. Bruce A, which finished its refurbishment in 2012, has a capacity of 3,004 MW and in 2014 generated 20.6TWh of energy (15% of the Ontario total). As part of the refurbishment Bruce Power receives a regulated rate of $59.48/MWh plus the cost of fuel with annual adjustments for inflation. As of 2015 Bruce A now receives approximately $76/MWh. Bruce B, which has not yet undergone refurbishment, has a capacity of 3,268 MW of capacity and in 2014 generated 24.95 TWh of energy (18% of the Ontario total). Under the Bruce A refurbishment agreement, power from Bruce B receives a minimum price of $45/MWh indexed to inflation. As of 2015 this price is now approximately $54/MWh. Together, the Bruce Nuclear Generating Station produces 33% of Ontario’s electricity and receives 22% of the Global Adjustment.

The IESO also has contracts with 7,750 MW of natural gas generation. These contracts are based on a net revenue requirement for the generator. This means that the generator receives a minimum monthly revenue regardless of the amount and value of the energy produced. These contracts were intended to ensure sufficient reliable generating capacity following the retirement of Ontario’s coal-fired generation. Gas generators are forecast to provide 11 TWh (8%) of Ontario’s energy in 2016. How much of this energy comes from gas-fired non-utility generators, which receive Global Adjustment payments from the OEFC, is not publicly available. Payments to OPA-contracted gas-fired generators are projected to be 1.2 billion (11%) of the Global Adjustment in 2016.

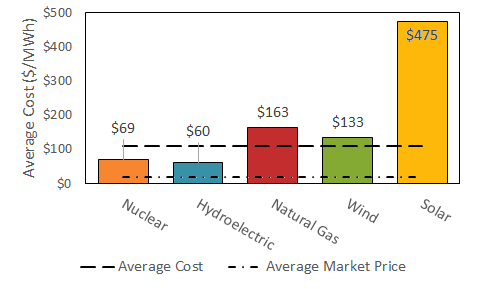

The IESO portion of the Global Adjustment also includes payments to renewable generation under numerous contract types including the Feed-in Tariff (FIT) program and the Renewable Standing Offer Program (RESOP). As of June 2015 there was a total of 8,496 MW of contracted renewable capacity in commercial operation. This is broken down into 486 MW of bioenergy, 2,252 MW of hydroelectricity, 1,824 MW of solar power, and 3,935 MW of wind power. Of these, solar has by far the highest cost of any generation, receiving on average $475/MWh. For comparison, wind power receives an average of $133/MWh, bioenergy an average of $130/MWh, and hydroelectricity $60/MWh (this value includes OPG’s regulated hydro generation). The average price paid to each type of generator is outlined in Figure 3. For the latest rate period the cost of this portion of the Global Adjustment is estimated to be $3.5 billion (30%).

Figure 3: Predicted average cost of electricity by source for 2016. The expected average electricity cost is $107.73/MWh and the expected average market price is $18.82/MWh.

Figure 3: Predicted average cost of electricity by source for 2016. The expected average electricity cost is $107.73/MWh and the expected average market price is $18.82/MWh.

Many of the policies and contracts that have defined Ontario’s electricity sector were put in place to ensure adequate supply expecting a large need for new generation to replace retiring coal plants and meet new load growth. However, since 2006 electrical demand has actually decreased by 8% in Ontario. As a result, these policies have generated a large surplus of supply in the province leading to very low wholesale market prices. These low prices are not passed on to the consumer because nearly all the electricity generation in the province has some form of price control shielding the producer from market prices.

This does not necessarily mean that the Global Adjustment has increased prices, despite accounting for 81% of the total electricity cost. In the absence of suppliers like OPG and Bruce Nuclear, which supply large quantities of low cost energy to the market and recover their costs through the Global Adjustment, the market price would increase significantly as more expensive generators are required to provide that energy. Additionally, revenue guarantee contracts between the IESO and natural gas generators ensures there is always sufficient fast-ramping capacity to meet load even during outages at other generators. This prevents spikes in the market prices because of supply inadequacy as sometimes seen in Alberta.

The combination of a wholesale electricity market, ad hoc contracts with large generators, and highly visible offer programs makes determining the effect of any single policy or directive difficult. In 2015, the Auditor General of Ontario reported that the Global Adjustment has cost $37 billion from 2006 to 2015 and will cost an additional $133 billion before 2032. However, it is not correct to attribute the entirety of this amount to mismanagement of the electricity sector. In addition to renewable energy contracts, the Global Adjustment includes the costs of ensuring adequate supply and maintaining grid reliability. Any criticism of the Global Adjustment must present an alternate method of providing these services.

1 – The Ontario Power Authority (OPA) was combined with the Independent Electricity System Operator in 2015. Sources prior to this merger will refer to the OPA by its previous name.

[1] Office of the Auditor General Ontario, “Electricity Power System Planning,” in 2015 Annual Report, Toronto: Queen’s Printer for Ontario, 2015, pp. 206–242.

[2] Ontario Energy Board, “Regulated Price Plan Price Report.” 2015.

[3] Ontario Energy Board, “Decision: OPG Payment Amounts for Prescribed Facilities 2014 and 2015.” 2015.

[4] Independent Electric System Operator, “Progress Report on Contracted Electricity Supply.” 2015.