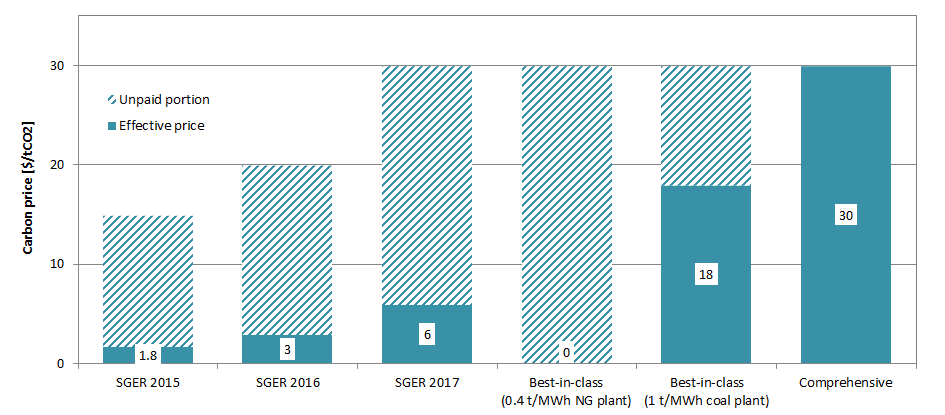

The new Climate Leadership Plan unveiled in Alberta to address greenhouse gas emissions uses a best-in-class carbon intensity standard for the electricity sector. Analysed in a previous post, power plants that have a higher carbon intensity than an efficient combined cycle natural gas plant (CCGT) must pay $30/tCO2 on emissions above the standard. For example, if the standard is 0.4 tCO2/MWh, and a coal plant has an intensity of 1 tCO2/MWh, the coal plant pays the carbon price on 60% of its emissions, meaning the price, in effect, averages to $18/tCO2 over all of the plant’s emissions. Applying the carbon price on a portion of emissions is similar to the existing SGER policy, as seen in Figure 1. But what if fossil fuel generators in Alberta had to pay the $30/tCO2 on all of the plant’s emissions (i.e. a comprehensive price), not just a fraction? What would be the impact on generation mix, emissions, revenue, and REC payments?

Fig. 1: Effective carbon prices: under existing Specified Gas Emitters Regulation (SGER) for 3 years; new $30/tCO2 best-in-class policy as it applies to two representative generator types; and the alternative $30/tCO2 comprehensive price applied to all emissions. An efficient natural gas (NG) plant with an intensity of 0.4 tCO2/MWh would not pay a tax if the best-in-class standard were 0.4 tCO2/MWh. A coal plant with an intensity of 1 tCO2/MWh would effectively pay $18/tCO2 if the best-in-class standard were 0.4 tCO2/MWh.

We present here an analysis of the Alberta power system to 2030, parallel to the one in the previous post, but applying the carbon price comprehensively on all carbon dioxide emissions from coal and natural gas plants. The modelling is done in OSeMOSYS with the objective to minimise the overall system cost, as in the previous post. Results indicate that a comprehensive tax leads to a system that meets the policy goals with a generation mix very similar to the best-in-class policy.

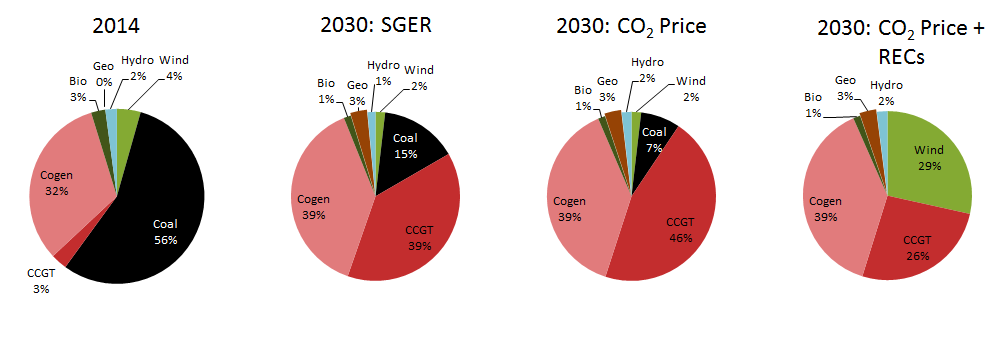

Fig. 2: Generation share by type (a) historic 2014, (b) 2030 under existing SGER policy, (c) 2030 under $30/tCO2 comprehensive carbon price, (d) 2030 under $30/tCO2 comprehensive carbon price and $15/MWh RECs. The replacement of ageing coal plants with combined cycle gas natural gas plants (CCGT) is accelerated with the carbon price. In order for renewables to make large contributions to the generation mix, RECs are required.

Very similar to the previous analysis, both the price on carbon and RECs are required to drive out coal and reach 30% renewables by 2030. Combined cycle gas plants (CCGT) are most naturally suited to replace ageing coal plants on the system. It is only with RECs that renewables, primarily wind power, are able to contribute significantly to the future generation mix, as seen in Figure 2. The comprehensive carbon price used this analysis makes gas-fired generation more expensive, and an average REC price of $15/MWh is sufficient in the model to achieve 30% renewable penetration in 2030.

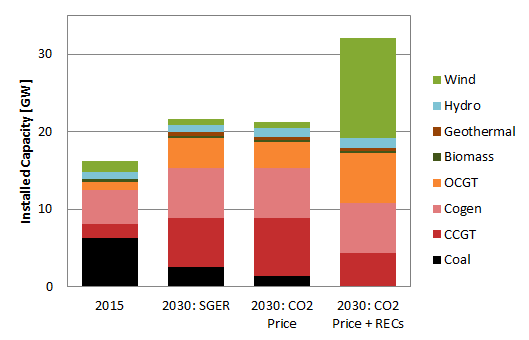

Fig. 3: Installed capacity in each scenario: current; 2030 under existing SGER policy; 2030 under $30/ tCO2 comprehensive carbon price; 2030 under $30/ tCO2 comprehensive carbon price and $15/MWh RECs. A system with extensive variable renewables, such as wind power, still requires firm generation capacity, here in the form of various natural gas plants.

The capacities corresponding to the generation mix are shown in Figure 3. Alberta maintains a large portion of cogeneration to support heat and steam demands in the oilsands. The extensive wind capacity in 2030 under the $30/tCO2 comprehensive carbon price is backed up by a large amount of dispatchable generation, most notably open cycle natural gas plants (OCGT).

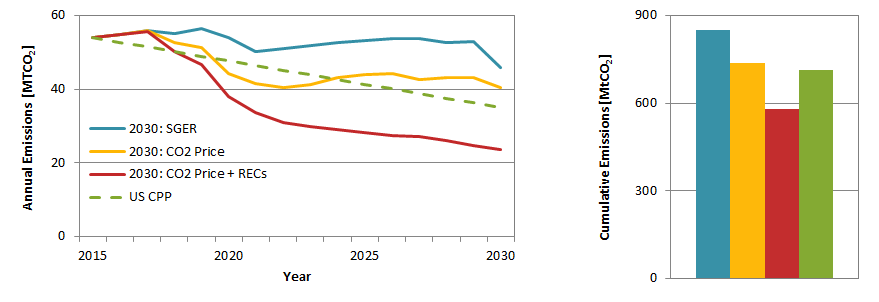

Fig. 4: (a) Annual emissions in each scenario. (US CPP is a stylised 32% emission reduction outlined by the US EPA.), (b) Cumulative 2015-2030 emissions for each scenario. The comprehensive $30/tCO2 carbon price with REC ($15/MWh average) policy (red line) reduces annual emission in 2030 by 56% compared to 2015. This modelled policy reduces cumulative 2015-2030 emissions (red bar) by 32% compared to the reference SGER scenario (blue bar).

Both the “carrot” and the “stick” contribute to emissions reductions. Applying a comprehensive carbon price of $30/tCO2 reduces annual emissions by 25% over the next 15 years, despite increasing electricity demand. Subsidising renewables through an average REC of $15/MWh reduces 2030 emissions by an additional 31% when implemented on top of the carbon price, as seen in Figure 4 (a).

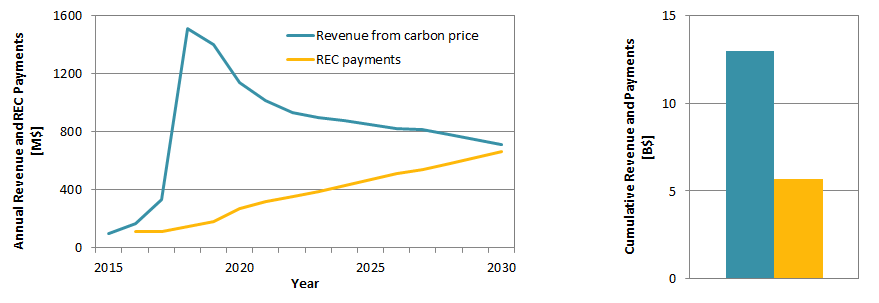

Fig. 5: (a) Approximate annual revenue from a comprehensive carbon price on the electricity sector covering all CO2 emissions and REC payments ($15/MWh average), (b) Approximate cumulative revenue from carbon price and REC payments from 2016-2030. A comprehensive carbon price appears to generate enough revenue to support REC payments.

A comprehensive price on carbon that covers all CO2 emissions from power plants generates significant revenue, even after coal plants are phased out. This is because natural gas remains a major source of generation on the system in 2030 and rather than taxing only the incremental emissions above the intensity by a best-in-class natural gas generator, gas plants pay $30/tCO2 on all emissions. At the same time, this makes natural gas generation more expensive so renewables require lower REC payments to be competitive in the system. As seen in Figure 5, revenue from the carbon price appears to exceed REC payments through 2030.

Alberta’s 2030 goals of phasing out coal and being 30% renewable are achievable with a comprehensive carbon price that covers all CO2 emitted from coal- and natural gas-fired plants. While this makes natural gas plants more expensive to operate, RECs are still required to achieve the target of supplying 30% of electricity from renewables.