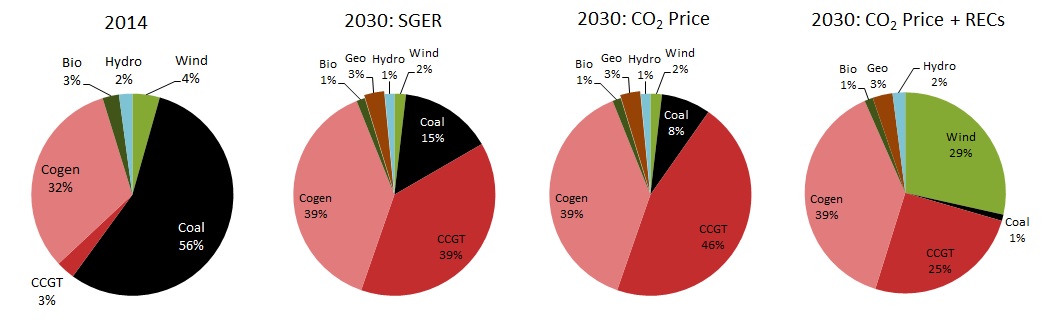

November 22, 2015 was an historic day for energy policy in Canada as Alberta unveiled its new Climate Leadership Plan. The policy addresses four main areas: electricity, oil sands, methane, and general consumption of fossil fuels. Electricity generation has historically been the source of most greenhouse gas emissions in the province, only recently surpassed by oil sands. Coal and natural gas still dominate the current generation mix (Figure 1 (a)), so the province is looking to decarbonise as demand for electricity continues to grow. Alberta’s new policy employs two mechanisms: a price on carbon (the “stick”), and incentives for renewable technologies (the “carrot”).

This new policy is aggressive, targeting a coal‑free, 30% renewable system in 2030. The province’s existing carbon policy, Specified Gas Emitters Regulation (SGER), includes a carbon levy, however it is relatively low – a few dollars per tonne effectively – and it applies only to large emitters. While details of the new policy have not been released and are still in development, the new carbon price of $30/tCO2 will apply to emissions above a reference carbon intensity set by the most efficient natural gas plant. For the following analysis, we have assumed the best-in-class standard carbon intensity is 0.4 tCO2/MWh in 2018, decreasing linearly to 0.3 tCO2/MWh in 2030. Revenue from this mechanism will be recycled back into the system in the form of incentives to renewable energy technologies like wind power. The Climate Change Advisory Panel recommends the use of Renewable Energy Credits (RECs) whereby electricity from renewable sources will be supplemented with payments of up to $35/MWh in addition to revenue from their regular participation in the market. It is believed this support is necessary to incent the significant investment in projects necessary to reach 30% penetration of renewables by 2030.

The 2060 Project, an IESVic initiative funded by the Pacific Institute for Climate Solutions, examines the impacts of policy mechanisms on future electrical systems in Canada. In the initial stages of this research, we have developed a comprehensive long‑term, techno-economic energy model of Alberta’s power system. Using this model, we have implemented the province’s new policy in the model to analyse the impact of the two mechanisms on the future generation mix and emissions.

Fig. 1: Generation share by type (a) historic 2014, (b) 2030 under existing SGER policy, (c) 2030 under new $30/t carbon price on emissions over best-in-class standard, (d) 2030 under new $30/t carbon price on emissions over best-in-class standard and $25/MWh RECs. Under the existing SGER policy, new combined cycle gas natural gas plants (CCGT) replace retiring coal plants. The new carbon price pushes additional coal plants out for new CCGT, but RECs are required to incent a build‑out of renewables.

Our research indicates that both the carbon price and RECs are important mechanisms to drive out coal and reach 30% renewables by 2030. Currently, renewables in Alberta contribute approximately 10% to electricity generation. As seen in Figure 1 (b), simulations with the existing SGER policy indicate the main generation change by 2030 would be to replace retiring coal plants with combined‑cycle natural gas turbines (CCGT). When the SGER carbon price is updated to the new carbon price in the model, additional coal plants are driven out of the market by 2030, substituting the energy almost exclusively with CCGT. These results are consistent with our paper “Decarbonising the Alberta power system with carbon taxes”, currently in review. Providing RECs on top of the price on carbon, renewables achieve 30% of the generation mix in 2030. Our modelling suggests an average REC value of $25/MWh may be sufficient to meet the 30% target, with wind power being the technology that benefits most.

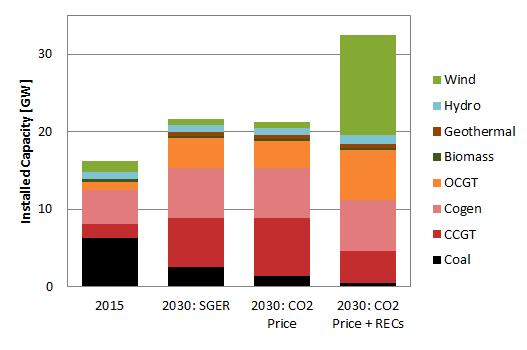

Fig. 2: Installed capacity in each scenario: current; 2030 under existing SGER policy; 2030 under new $30/t carbon price on emissions over best-in-class standard; 2030 under new $30/t carbon price on emissions over best-in-class standard and $25/MWh RECs. A system with extensive variable renewables, e.g. wind, requires back‑up capacity, such as that provided from open cycle natural gas turbine plants (OCGT).

Although the carbon price with REC scenario delivers the same amount of electricity as the other scenarios in 2030, the system requires significantly more capacity as seen in Figure 2. The first reason for this is that wind has an annual capacity factor of 30-40%, while baseload generators like coal, cogen and CCGT can reach ~85%. The other reason is that wind power requires dispatchable back‑up to maintain adequate reliability. Assuming this back-up service is provided within Alberta, this results in additional capacity from open cycle natural gas turbines (OCGT). The combined capacity of wind and OCGT in this 2030 scenario comprise 60% of the total system capacity. This is considerably more than the 15% combined share for wind and OCGT on the current system.

While our model has a constraint ensuring sufficient dispatchable generation to maintian reliability, the Alberta system presently relies on price signals in the market to incent investment in peaker plants (e.g. OCGT). The shift in generation mix from being primarily baseload to an increasing presence of variable and peaker plants may require changes to the current energy‑only market to ensure there is sufficient investment in technologies that can help maintain system relibility. One option would be to reward flexible and firm generation through new markets, as discussed by Sopinka and Pitt (http://www.sciencedirect.com/science/article/pii/S1040619013002376).

Reaching 13 GW of wind power by 2030 requires an average annual growth rate for wind power in the province of 15.8%. This aggressive development would be comparable to recent activity in Ireland, which had 5% renewable penetration in 2005, and 18% wind penetration in 2014.

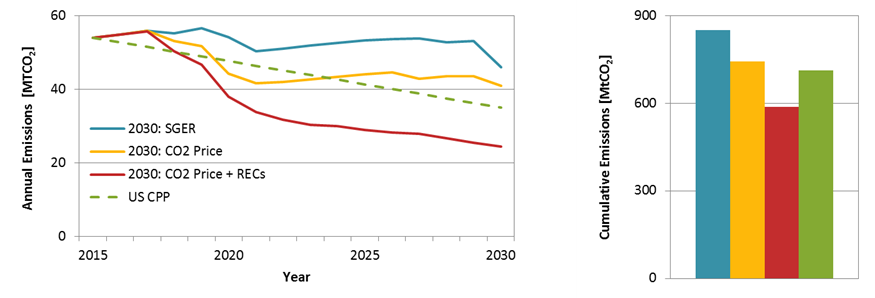

Fig. 3: (a) Annual emissions in each scenario. (US CPP is a stylised 32% emission reduction outlined by the US EPA.), (b) Cumulative 2015-2030 emissions for each scenario. The new $30/t carbon price on emissions over best-in-class standard with $25/MWh REC policy reduces annual emission in 2030 by 55% compared to 2015. The new policy reduces cumulative emissions by 31% compared to the reference SGER scenario. After natural gas replaces coal, emission reductions are harder to achieve, as demonstrated by the red curve leveling out in (a).

A carbon price of $30/tCO2 on emissions over the best-in-class standard results in 2030 emissions that are 24% below current annual emissions. Application of the REC policy drives 2030 emissions down an additional 31%. This suggests that the carbon policy is effective because of both the carrot and the stick. It is worth noting that this combined policy out‑performs targets of the US EPA Clean Power Plan.

As seen in Figure 3 (a), the greatest reductions in annual emissions occur before 2022, after which reductions become more difficult to achieve. As was shown in our “Decarbonising the Alberta power system with carbon taxes” paper, these large, early reductions can be attributed to replacing older coal plants with CCGT. It is also shown in the paper that this transition from coal to CCGT is the most cost effective means of reducing emissions in the system.

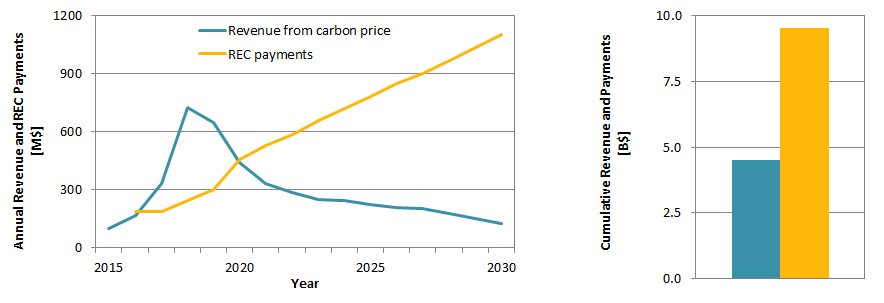

Fig. 4: (a) Approximate annual revenue from new $30/t carbon price on emissions over the best-in-class standard and $25/MWh average REC payments, (b) Approximate cumulative revenue from new $30/t carbon price on emissions over the best-in-class standard and $25/MWh REC payments from 2016-2030. The annual revenue decreases with the retirement of coal plants, while REC payments increase along with new wind power.

Revenue from the carbon price will level off as the system decarbonises, while REC payments will increase along with new generation from renewables. The greatest annual revenue comes in 2018 when the low SGER carbon price is replaced with the new policy, and revenue then decreases as coal-fired generation is phased out. In the model, it is assumed an average REC credit of $25/MWh is paid to wind, hydro, biomass, geothermal, and solar. The majority of the REC payments by 2030 are to wind generation, which, as shown in Figure 1 (d), provides the most electricity out of the renewables.

There are some assumptions in our model that should be recognised. New wind farms are assumed to have capacity factors equivalent to the historical average of current farms. In reality, it will be increasingly difficult to find locations in the province with such high quality wind resources that are also close to transmission infrastructure. The model uses the “Main Outlook” load growth and cogeneration capacity predicted in the AESO 2014 Long-term Outlook, which may prove to be high given the downturn in oil prices and oil sands activity that drives much of the Alberta economy and electricity demand.

The 2060 Project is also employing a high resolution dispatch model to explore the challenges of operating a system with such a high penetration of variable renewables. The proximity of British Columbia’s vast hydropower resource can be a beneficial aspect of a more integrated power system under appropriate policy and transmission interconnections. The use of neighboring jurisdictions to balance variability is similar to how Denmark relies on Norway, Sweden and Germany to maintain reliability.

In summary, Alberta’s new carbon policy can achieve significant CO2 reductions. Both the carbon price stick, and carrot subsidy of renewables through RECs are required to meet the province’s goals of phasing out coal plants and generating 30% of electricity from renewables.